Insurance company rates depend on many factors, not the least of which includes the vehicle's safety ratings. Besides your age, gender and personal driving record, where you live and the model of car you own, its safety features and its crash-test ratings all figure into the ways the insurance companies determine the cost of your insurance. Insurance statistics show that young male drivers, for example, pay more for insurance than their female counterparts because accident information indicates these drivers present the greatest risk. These drivers typically choose high-performance cars or cars with fewer safety features than other drivers.

Insurance company rates depend on many factors, not the least of which includes the vehicle's safety ratings. Besides your age, gender and personal driving record, where you live and the model of car you own, its safety features and its crash-test ratings all figure into the ways the insurance companies determine the cost of your insurance. Insurance statistics show that young male drivers, for example, pay more for insurance than their female counterparts because accident information indicates these drivers present the greatest risk. These drivers typically choose high-performance cars or cars with fewer safety features than other drivers.

There are exceptions, however, as good students, older, and safer drivers can receive discounts on their insurance rates over students with poorer grades, younger drivers, and people with poor driving records and cars with safety ratings that are not as good as other vehicles. Along with your age, gender and driving record, insurance companies also look at the ratings for the area in which you live. Rural areas have a lower risk of vandalism and theft than is typically found in more populated areas. A car with good crash-test results and safety features can help to lessen the high risks associated with these other factors.

Types of Crash Tests

The Insurance Institute for Highway Safety (IIHS), a not-for-profit organization committed to education and accident research, is also dedicated to reducing the number of accidents on the nation's highways and roads. It works with college-based and other research labs to collect and analyze data on crash tests conducted on new vehicles. Every year it, and the government, provide safety ratings on the newest vehicles, rating them in order of their safety features and crash-test results.

The Insurance Institute for Highway Safety (IIHS), a not-for-profit organization committed to education and accident research, is also dedicated to reducing the number of accidents on the nation's highways and roads. It works with college-based and other research labs to collect and analyze data on crash tests conducted on new vehicles. Every year it, and the government, provide safety ratings on the newest vehicles, rating them in order of their safety features and crash-test results.

IIHS cites vehicles with outstanding results into two categories, its "Top Safety Picks +" class and "Top Safety Picks" each year. Vehicles in the first class must receive good ratings in at least four out of the five areas analyzed, and at least an "acceptable" in the last test. To receive high ratings in the "Top Safety Picks" class, the vehicle has to receive good ratings in roof strength, and in the moderate overlap for side, front, and head-restraint and airbag tests. Vehicles are tested and compared to other vehicles in their same class. Safety test results for trucks are not compared against crash-test results for SUVs. Some of the classes include large family cars, midsize moderately priced cars, and midsize and large luxury cars. Other classes include minivans, minicars, small cars, large pickups, and midsize moderately priced cars.

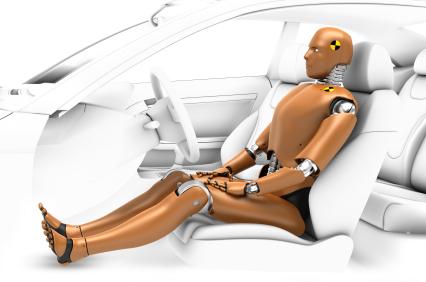

All new vehicles undergo a series of crash tests to determine how well the vehicle performs under the stress of a crash. Some of the tests include front crash test performance, simulations of the impact of crashes on occupants in the car via crash-test dummies, airbag and head-restraint effectiveness, rear-end and side- impact crashes. College-based and other research labs across the country put cars through a series of maneuvers in the lab and on specially designed tracks to monitor their performance in these tests.

Tests also include the newer features on cars such as how well the car's safety features prevent accidents. Safety ratings for SUVs and midsize cars include an evaluation on how well their crash avoidance systems work. Reviewers evaluate forward collision warning and automatic braking systems for these test results.

Other crash tests involve the safety of children in the car with respect to airbags and child safety, car and booster seats. Parents can review the ratings of child safety seats on the IIHS site.

Effects on Car Insurance

After all the different types of crash tests are complete for a new vehicle, it receives its overall safety rating. When vehicles receive poor ratings because of these tests, insurance companies review these ratings in comparison with the other factors -- your driving record, age and where you live -- to determine the risk involved with insuring your vehicles. Insurance companies evaluate the cost of insurance for a vehicle by its risk factors.

Vehicles with lower safety ratings or recalls represent greater risks to insure them. In other words, cars labeled with higher risk means that those vehicles and their drivers are more likely to be in an accident. If a driver and a car are more likely to get into an accident, the costs to the insurance company are more. Those costs are passed on to the driver in the form of higher premiums.

IIHS makes its test protocols transparent for both car manufactures and customers looking for more information on vehicle safety features. It also compiles vehicle loss information, rating how well cars perform in six insurance categories: personal injury protection, medical payments, bodily injury, collision, comprehensive, and property damage liability. Insurance companies use this statistical information along with crash-test results and the other factors mentioned to develop an insurance quote customized to you and your vehicle. Before you buy a new car, research its safety ratings online at the IIHS website. When buying a used car, compare insurance company ratings and check the history of the car's title at the National Motor Vehicle Title website to find out if the car was ever in a crash, stolen or repaired after being totaled.

By: Daniel Watson