Auto insurance costs more in Montreal than anywhere else in Quebec.

Like any big city, there are three realities Montreal drivers must face on a regular basis: traffic, road repairs and construction, and the high cost of auto insurance. On this latter point, drivers in Montreal pay the highest premiums in the province. According to Kanetix.ca, car insurance in Montreal comes in at an estimated $756 a year, about 23 per cent higher than the provincial average of $616.

Comparing Quebec auto insurance rates

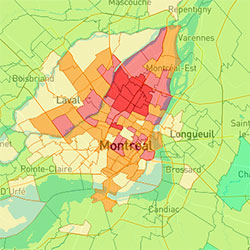

The results come from InsuraMap, an interactive tool from Kanetix.ca that lets you compare auto insurance rates from across the province to determine the most expensive-and inexpensive-areas for auto insurance. Based on a 35-year-old driver of a 2014 Honda Civic with a clean driving record, Kanetix.ca's InsuraMap charts out how significantly premiums can vary when all else is equal, except the postal code.

The cost of car insurance for Quebec's 10 largest cities

With almost 2 million residents living on the island of Montreal alone, this area is by far the most populated in Quebec. As a result, the odds of collisions, vandalism, theft and, ultimately, claims are considerably greater. However, Montreal is not the only area with higher than average premiums, drivers in Laval also pay more than most for their Quebec car insurance coverage.

| Rank | Estimated Premium | City |

| 1. | $756 | Montreal |

| 2. | $728 | Laval |

| 3. | $616 | Gatineau |

| 4. | $579 | Terrebonne |

| 5. | $572 | Longueuil |

| 6. | $552 | Trois-Rivieres |

| 7. | $546 | Sherbrooke |

| 8. | $545 | Quebec City |

| 9. | $529 | Saguenay |

| 10. | $514 | Levis |

From top to bottom, the difference in rates is significant: over $240 per year.

Car insurance rates beyond Quebec's big 10 cities

All of Quebec's big 10 cities have populations of more than 100,000 residents; however, there is another grouping of cities in the province where the population size ranges from 50,000 to 100,000. How did these cities fare when it comes to the price of car insurance? In comparison to Montreal and Laval, they fare well: all have an estimated car insurance premium of less than $600 per year.

In some of the cities of the Greater Montreal Area, for example, estimated premiums are about $160 to $200 less than what Montreal drivers pay. In Repentigny ($593), Blainville ($592), Saint-Jerome ($590), Brossard ($577), and Mirabel ($556) estimated premiums are considerably lower than what is found in Montreal.

Meanwhile, in Saint-Jean-Sur-Richelieu ($540), Saint-Hyacinthe ($535), Drummondville ($514), and Granby ($507) estimated premiums are also below the $616 provincial average.

There's more to your insurance rate than the size of the city you live in

According to Statistics Canada's latest census information, the most populated cities in Quebec are in order: Montreal, Quebec City, and Laval. How is it then that Quebec City isn't in the top three most expensive for car insurance?

The fact is, population, in and of itself, does not determine auto insurance rates. It's really about the likelihood of a claim. If you live in a city or town that-for whatever reason-reports more claims (or more costly claims) than other areas, your premiums are likely going to be higher.

In addition to where you live, your personal driving record and insurance history also have an impact, as does the type of vehicle you drive, your annual kilometres driven, your commute, and other variables such as the age and experience of any additional drivers on the policy. Together, all of these factors go into determining your car insurance premium.

Tips to save on car insurance

Whether you live in a big city or small town, there are ways to save on the premiums you pay:

- Maintain a good driving record.

- Bundle your car and home insurance to save between five and 15 per cent.

- Increase your deductibles and save up to 10 per cent. Keep it affordable though, as this is the amount you'll need to pay should you need to submit a claim.

- Pay your premiums annually, in one lump sum, to avoid the extra fees that some companies charge to administer payments that are spaced out over the year.

- Ask your insurer for a list of their discounts as there may be opportunities to save money that you didn't know existed, or that your provider didn't know to offer you before.

- Be mindful of the insurance costs when buying a new car. Some cars cost more to insure because they're more likely to be stolen.

It goes without saying that we're keen on comparison shopping, but it is absolutely one of the easiest ways to save. Rates often change-not just with your insurance provider, but all providers-and the company who offered you the best rate two years ago or even last year, may no longer offer you the best deal today. Compare car insurance quotes at Kanetix.ca today; there's no easier way to shop around for the coverage you need.