The cost of car insurance can vary considerably because there are a lot of factors that go into calculating your rate. Your driving record, the make and model of your car, and the risk of it being stolen are just a few of the many variables used by insurers to establish what you pay for car insurance. What is often lesser known though, is that where you live also matters and can play a big part in whether you pay more or pay less for your car insurance premiums.

Comparing Quebec auto insurance rates

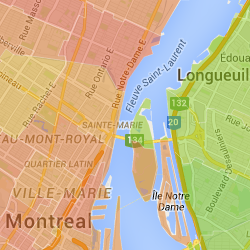

KANETIX's Insuramap lets you compare auto insurance rates according to postal codes, and aggregates data from across Quebec to determine the most expensive-and affordable-areas for auto insurance. You can use it to discover the going rates of car insurance in a given neighbourhood or city and see how much people pay on average in a given region. And, since it is a KANETIX tool, you can also get insurance quotes directly by simply clicking on "Get a quote" and then answering the usual questions.

- Related Read: The 10 Most Expensive & Cheapest Areas For Auto Insurance in Alberta

- Related Read: Top 10 Most Expensive Cities for Car Insurance In Ontario

Not surprisingly, the data confirms that people living in greater Montreal pay the most for car insurance while those living in L'Ancienne-Lorette, a Quebec City suburb, pay the least.

The Typical Cost Of Car Insurance For Quebec's 10 Largest Cities*

| Rank | City | Avg. Annual Insurance Cost** |

Compare To Provincial Avg** |

| 1. | Montréal | $714 | 29% higher |

| 2. | Laval | $642 | 16% higher |

| 3. | Saguenay (formerly Chicoutimi) |

$602 | 9% higher | 4. | Longueuil | $597 | 8% higher | 5. | Sherbrooke | $567 | 2% higher | 6. | Terrebonne | $557 | 0.5% higher | 7. | Gatineau | $516 | 7% lower | 8. | Trois-Rivières | $512 | 8% lower | 9. | Québec | $431 | 22% lower | 10. | Lévis | $427 | 23% lower |

The annual cost of auto insurance is higher than average in the first five cities, while the rest stand slightly above or below the provincial average of $554 per year. This data is based on an average premium for a 35-year-old driver with a clean driving record.

Rate differences

L'Ancienne-Lorette pays the least of all places in Quebec with an average of $325 per year. This is 41% below the provincial average. Other motorists who pay the least live in Rivière-du-Loup ($342), Pintendre ($398) and the two boroughs of the city of Lévis, Saint-Jean-Chrysostome ($413) and Saint-Étienne-de-Lauzon ($419).

Tips to save on car insurance

Do you live in a city where the average price of car insurance is higher than most? Here are some tips to help reduce the amount of premiums you pay:

- Maintain a good driving record

- Combine car and home insurance and save between 5 and 15%

- Increase your deductibles and save up to 10%. Keep it affordable though, as this is the amount you'll need to pay it in case of a claim

It goes without saying that comparing prices remains one of the most effective ways to save. Compare car insurance quotes for free on KANETIX.ca today to see if you could save hundreds of dollars on your car insurance.

*Average annual premiums for a 35-year-old driver with a clean driving record.

**Figures have been rounded.