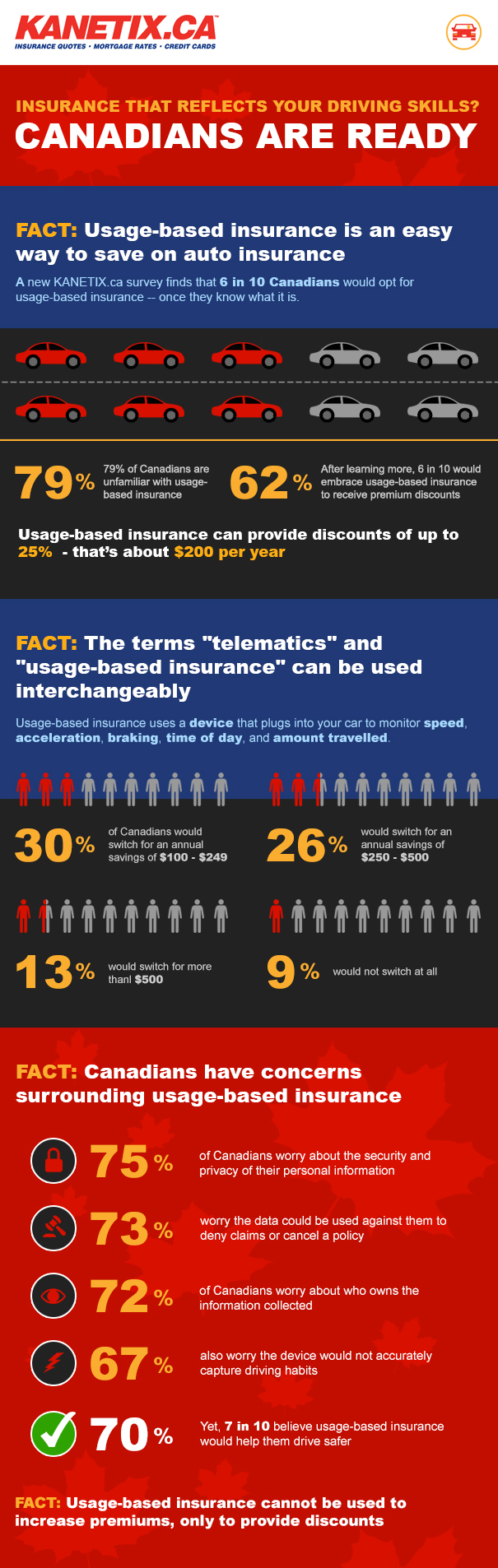

KANETIX.ca survey suggests, yes: six in 10 Canadians would opt for usage-based insurance, despite privacy concerns.

The big buzz in auto insurance is usage-based insurance programs that monitor your driving to determine if you'll get a discount off your insurance. The discounts can be significant too, up to 25 per cent off your auto insurance premium. But, like anything new, there are a lot of unknowns.

KANETIX.ca commissioned a survey to delve into the psyche of Canadian drivers to find out if consumers are ready for usage-based auto insurance. The survey, conducted by Leger, looked at Canadian consumers' familiarity with the notion of usage-based insurance, their willingness to take part in a program, savings expectations, and concerns drivers have with the whole idea of it all.

Usage-Based What?

The majority of Canadians are not familiar with usage-based insurance; nationally 79 per cent of Canadians are unfamiliar with it. In Ontario and Alberta, 76 per cent said they were unfamiliar with usage-based insurance, while in Quebec 79 per cent were unfamiliar with the concept. So what is it exactly?

A usage-based insurance program monitors how you drive through a device that plugs into your vehicle. It monitors acceleration, braking, the time of day you drive, and distance driven to determine if your driving habits warrant an insurance premium savings discount.

Sign Me Up!

Six in 10 Canadians say they're willing to give usage-based insurance a shot if there's a chance to pay less for their auto insurance coverage, and seven in 10 believe a person would drive safer knowing their driving behaviour was being monitored for insurance savings purposes.

Myth busting:Twenty per cent of Canadians believe they may pay more for their auto insurance if they signed up, but this is actually an unnecessary concern. Usage-based insurance programs are set up to see if you qualify for a discount and how much of a discount you'll get. It is not going to lead to a higher premium.

How Much Would It Take?

With potential savings of up to 25 per cent off your insurance premium, usage-based insurance programs offer good drivers an opportunity to save a good chunk of change. In real dollars and cents, two-thirds of Canadians would switch to a usage-based insurance program if they were going to save at least $100.

- 30 per cent of Canadians would switch to a usage-based insurance program if they could save between $100 and $249 a year;

- 26 per cent would switch for savings of $250 to $500; and,

- 13 per cent would only switch if the savings potential was greater than $500.

Telematics: Big Data, Big Concerns

Hands down, the biggest concerns drivers have about usage-based insurance programs are about privacy and how the information collected could be used.

- 75 per cent of survey respondents were concerned about the security of their personal information and if it could be stolen;

- 73 per cent were concerned that the information about their driving behaviour could be used against them to deny an accident claim or cancel a policy;

- 72 per cent were concerned that the insurer-not the driver-owns the information collected;

- 68 per cent were concerned that the information would be shared with other auto insurers; and,

- 67 per cent were concerned the device won't capture their driving habits accurately.

Usage-Based Insurance: Individualized Insurance

At its most basic level, your auto insurance premiums are determined by grouping like-minded drivers together; where you live, the type of car you drive, and your insurance history and driving experience. But with usage-based insurance, the formula is fine-tuned; the premium you end up paying is customized to better represent how you-specifically-drive.

For good drivers, it's a great opportunity to pay less for car insurance. The better you drive, the more you save. And for drivers who are less than perfect, your rates will not increase; you'll simply not qualify for the discount.