Will your auto insurance provider still offer you the best car insurance rate after you've moved?

Will your auto insurance provider still offer you the best car insurance rate after you've moved?

Chances are when you are looking to move, whether it is because you're planning on buying a new home or moving to a new apartment, the last thing you think about is how it will affect your car insurance premiums. And, who can blame you? But the fact is that when you move, your auto insurance premiums will likely change; for the lucky, it might mean paying less for car insurance, for others, it might mean paying more.

Too often, when it comes to moving, people figure they'll just tell their car insurance company of their change in address who will then adjust their rate, and whatever the rate ends up being, is what it is. After all, they'll still give you the best car insurance rate just like they did last time you shopped around, right? This isn't always the case as every insurance company has a different claims experience with your new neighbourhood, and this will be reflected in the new rates you're offered.

- Related Read: 18 Myths About Car Insurance

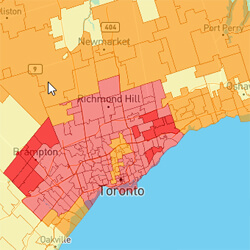

This is exactly what was reported in thestar.com recently when a Toronto driver found that after she moved her auto insurance went up $600 a year. In the article, the reporter, using Kanetix's InsuraMap, highlights how neighbourhoods stack up against each other and encourages drivers to shop around as it "is the best way to keep insurance costs in check."

- Want to see how rates vary by neighbourhood? Kanetix's InsuraMap charts it out.

What goes into calculating your auto insurance rate?

There's a lot that goes into determining your auto insurance rates. Where you live, your driving and insurance history, your driving record and the car you drive all play a role. But, when everything else is equal and all that has changed is your address you might wonder why your rates change, especially if you've moved within the same city or town.

Basically, it boils down to your insurer's claims experience in your new neighbourhood with like-minded drivers like yourself. No two insurers are the same, and while one insurer may find that your new neighbourhood is more prone to collisions, theft or vandalism based on their policyholder's past claims, another insurer's actuaries may find the opposite is true. It all depends on the pool of drivers insured by the company in your new neighbourhood.

What's it all mean?

In a nutshell, if you're changing addresses you may also have to change insurance providers to lower your car insurance rate.

- Related Read: Top 15 Tips to Cheaper Auto Insurance

The company who currently insures you may not provide you the best auto insurance rate for the area where you are moving, and not shopping around for your car insurance can be costly. After you've settled into your new residence, make sure you're still getting the best rate out there and compare car insurance quotes. At Kanetix.ca, we shop the market to help you get the lowest rate, and our customers save an average of $750 because of it.