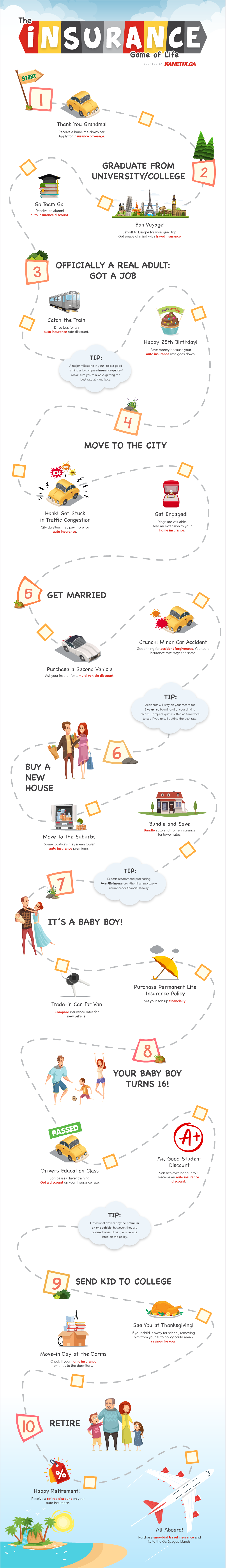

Teenagers look forward to their sweet 16 and the freedom that comes with getting their driver's licence. What they may not realize is that this milestone also opens them up to the world of insurance. Car insurance is generally the first of many insurance policies purchased over a lifetime. So, we've compiled at list of ways to save from passing your driver's test to retirement, and every step of the journey in-between.

Saving on Your Car Insurance

Whether you receive a hand-me-down car from a relative or your parents decide to add you as an occasional driver, you'll need car insurance before you set out on the highway.

Although inexperienced drivers generally pay higher premiums, these circumstances won't last forever. The more experience you gain and additional time behind the wheel, may result in savings down the road.

It is beneficial to compare insurance quotes at each one of these automotive milestones.

Young drivers

Taking an approved driver's education course can reduce auto insurance premiums by over $1,000 per year and improve your defensive driving skills.

Experienced drivers

Auto insurance premiums typically decrease as you gain experience and turning 25 seems to be that benchmark. However, this rate drop won't magically happen on your birthday. To secure a lower premium you should maintain a good driving record and speak with your insurance provider on your next renewal date.

Retired drivers

Retirement means you won't have to make that long commute to work anymore. Your insurance provider may help you celebrate with a retiree discount on your auto insurance.

More Insurance Discounts

Savings may be found from your alma mater to your employer. Here is a list of additional discounts you may want to ask your insurance provider about:

- Alumni benefits: Most colleges and universities partner with companies to offer their alumni a wide range of deals on products and services, which includes insurance. Check out what your alumni benefits have to offer or ask your insurance company if they provide this discount.

- Group benefits: If you are lucky enough to receive group benefits through work, you may also save on auto or home insurance. Make sure you read your benefits package to see what is included.

- Accident forgiveness: If you have a good driving record you may qualify for accident forgiveness. This add-on can help protect your insurance rate in the event of your first at-fault accident.

Accidents will stay on your record for six years, so be mindful of your driving record when switching providers. Most likely your "claims free" status won't carryover to your new insurance company. - A multi-vehicle discount: Insuring a second vehicle under one provider may have its benefits. Ask your insurance company for a multi-vehicle discount.

- Driving less: Inform your insurance provider if you start driving less. This decreases your risk of being involved in an accident and can lower your premiums. Taking the train or other forms of transportation can save you on car insurance.

- Removing absent drivers: Removing your child from you auto insurance policy while they are away at school can lower your insurance premiums.

Where you may see premium increases

Having a good driving record is key to maintaining low auto insurance premiums. However, even without an accident or ticket your insurance premiums may go up based on where you live.

According to the Insurance Bureau of Canada (IBC), "Higher density equals more risks, more accidents and more thefts." This means your auto insurance premium will likely increase when you move to the city. Consider bundling your car and home insurance for a multi-line discount.

Compare quotes often at Kanetix.ca to see if you're still getting the best rate.

Ways to save on Home Insurance

Moving out is a major step into adulthood. Most often, students reach this milestone when they go off to university or college. After graduation, renting an apartment or buying a home may be next. Here are a few ways to save from tenant to home insurance.

Student accommodations

Students who have ties to home may still benefit from the insurance standpoint. Check with your insurance provider to see if your home insurance extends to the dorms. Laptops, textbooks, and other student necessities may be covered under your policy even while away from home.

Renting an apartment

Purchasing tenant insurance can protect your possession and give you peace of mind. However, renter's insurance doesn't typically cover your roommates even though you all live under the same roof.

However, if your partner moves in, consider adding them to your policy and increasing your coverage. More personal property means a higher replacement value.

Purchasing a home

Experts recommend purchasing term life insurance rather than mortgage insurance for financial leeway. In the event you need to file a claim, mortgage insurance won't cover funeral expenses or other burdens. Whereas term life insurance can be used towards your mortgage and your other expenses.

Downsizing

Condominiums generally have building insurance for common areas and the structure itself. However, it is recommended that residents purchase condo insurance to cover their own suite.

Home or tenant insurance increases

There are some milestones in life where you may need to increase your home insurance, these are a few:

- Getting engaged: Adding an extension to your home or tenant insurance can give your high value items the necessary coverage.

- Home renovations: Upgrade your home insurance along with your house. Informing your home insurance provider of any major renovations can keep your policy up-to-date and ensure your coverage extends to the new value of your property.

Where you may see premium decreases

Location can play a part in your auto insurance as well as your home insurance. Some locations can mean lower insurance rates. So, moving is a prime time to shop around.

Bundling your home and auto insurance can save you hundreds of dollars annually.

Ways to save When You Travel

If you are a student setting off on your grad trip or a snowbird flying south for the winter, travel insurance can keep you covered while abroad. Emergency medical coverage can save you hundreds, if not thousands, of dollars in unexpected medical fees.

Here are a few ways you can save on travel insurance:

- Annual policy: If you plan on travelling more than once a year, consider purchasing a multi-trip or annual policy. This can save you money in the long-term.

- Credit card: If you purchase your trip on a credit card you may have coverage. If you do, only purchase the additional coverage you need.

- Trip cancellation insurance: This coverage can protect the value of your trip, which may especially useful if your adventure is extravagant and costly. Whether you become unemployed or there is a death in the family, you may be able to recoup the costs with trip cancellation insurance.

No matter what stage of life you are at, there are many ways to save on home, auto, and travel insurance. At Kanetix.ca you can compare quotes from over 50 companies within minutes; saving you time and connecting you with the best rate.